Frequently Asked Questions (FAQs)

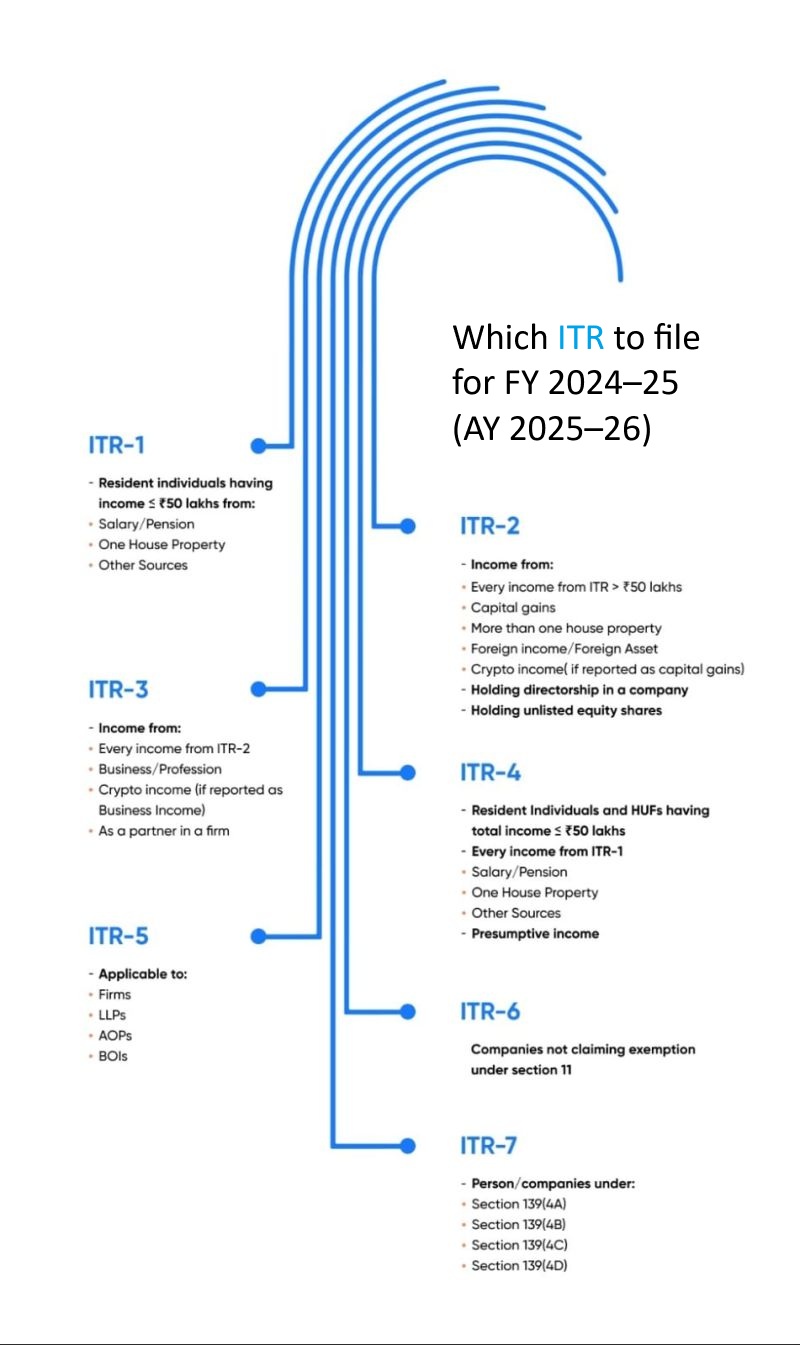

It depends on your income type, total income, and whether you have business, capital gains, or foreign assets. Still unsure? We’ll help you pick the right one.

Your return may be considered defective and could be rejected by the Income Tax Department. Always file using the correct form.

Yes — but only by revising your return before the deadline. Corrections must be made using the correct form.

Yes! ITR-1 (Sahaj) is the simplest, but it’s only for salaried individuals with income up to ₹50L and no capital gains or business income.

Use ITR-3 if you maintain books or have capital gains. Use ITR-4 if you opt for the presumptive tax scheme (Sec 44ADA).

Not always—but it’s recommended if:

- You want to claim a refund

- You have foreign assets or income

- You’ve made high-value transactions